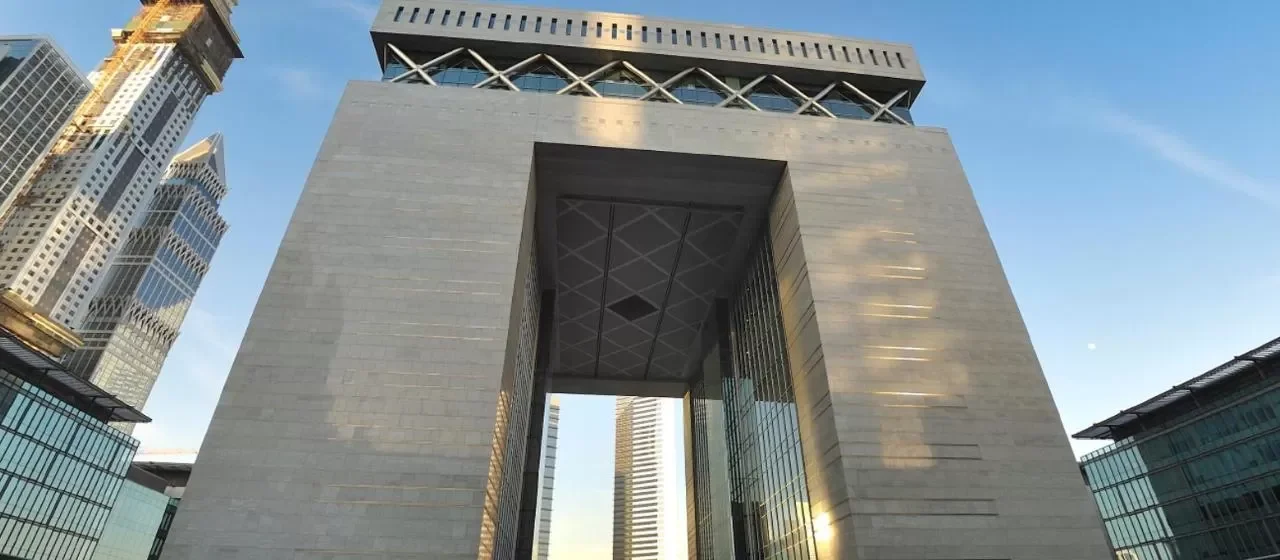

Types of Employment Contracts in the DIFC: Understanding Your Rights and Obligations. Introduction Employment Law in the Dubai International Financial Centre (DIFC) governs the relationship between employers and employees within the jurisdiction. One important aspect of this law is the different types of employment contracts that can be established between employers and employees. These contracts...

“Empower your workforce with confidence – Navigating Employment Law in the DIFC.” Introduction Employment Law in the Dubai International Financial Centre (DIFC) is a set of regulations and provisions that govern the relationship between employers and employees within the DIFC. These laws aim to protect the rights and interests of both parties, ensuring fair treatment,...